Even so, OnDeck commonly delivers bigger desire fees than rivals. Moreover, you’ll have to be ready to make day by day or weekly payments.

If you’re working with an online lender, you’ll generally be able to accomplish the appliance method speedily. These corporations generally ask for essential specifics of your business and a few supporting paperwork.

All of our articles is authored by extremely experienced gurus and edited by subject matter experts, who be certain every little thing we publish is aim, correct and reputable. Our banking reporters and editors center on the points buyers treatment about most — the most effective financial institutions, most recent fees, different types of accounts, dollars-preserving guidelines and a lot more — in order to truly feel self-confident as you’re taking care of your hard earned money.

Editorial Take note: We generate a Fee from associate links on Forbes Advisor. Commissions tend not to have an affect on our editors' views or evaluations. A business line of credit might be a powerful Software to include ongoing economical demands.

Repayment time period: Secured loans could involve everyday, weekly or month-to-month payments. Crunch the numbers just before signing within the dotted line to make sure you can manage the repayment schedule.

Refinancing and equity guideToday's refinance ratesBest refinance lenders30-year mounted refinance rates15-calendar year set refinance ratesBest cash-out refinance lendersBest HELOC Lenders

A lot of lenders will need a ensure that you will be personally responsible for any financial debt you incur while in the party your account goes into default.

That will help you find the greatest line of credit in your venture, we in contrast 18 lenders and 17 knowledge points, like Expense to borrow, qualification specifications and repayment options. Funbox is our top rated decide on as a consequence of its accessible borrowing necessities and fast approvals.

Showcase Your Business Achievements:Â Spotlight any important achievements, milestones, or successes your business has professional. This may enable Develop believability and illustrate the probable for development and accomplishment.

But although business lines of credit Possess a whole lot heading for them, They might are available in reduce loan quantities and produce other disadvantages. Consider how a business line of credit will work, its pluses and minuses and when to consider using 1 to find out if this funding is the proper in shape for your personal business.

The ideal collateral for any business loan is an asset that a lender can liquidate promptly. For this reason, lenders may take into account hard cash, price savings accounts or certificates of deposit as major collateral solutions.

The documents you’ll need to accomplish your business loan software will vary by lender. Normally, nonetheless, you’ll be requested to deliver some, Otherwise all, of the following:

Precisely what is a business line of credit? How do business lines of credit perform? Needs for your business line of credit Positives and negatives of a business line of credit What to think about when getting a business line of credit Routinely requested concerns Again to top rated

A small business line of credit has far more in typical with how to secure a small business loan a small business credit card than with a small business loan.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

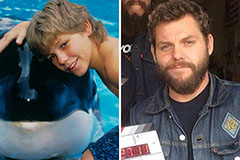

Alana "Honey Boo Boo" Thompson Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!